According to a recent study published in August 2021 in AGEFI, 91,360 out of the 603,602 Swiss companies with fewer than 250 employees, that is over 15%, are looking for a successor to their owner aged over 60. These figures are corroborated by various banking and business consultancy studies published on this topic. Although the owner’s age is not the only factor to consider, population trends and changes in society have led to many questions being asked about the medium- and long-term sustainability of the economic fabric on which Switzerland’s strength has been built: the predominance of privately-owned small and mid-sized businesses (SMEs).

And businesses need to plan ahead for a transfer rather than rushing into it at the last minute. The transfer price is far from being the only factor to consider. The sustainability of the business, job retention and relationships with local suppliers and subcontractors are significant issues which will have an impact on the local economic landscape. Transferring a business is a strategic project. It can be a very emotional experience which has an impact at every level: legal, financial, accounting, taxation and communication. It is a complex and specialised process.

It is essential for the owner to engage a team of experienced professionals. A dedicated team can provide support for the owner by offering realistic, bespoke advice enabling the owner’s objectives to be ascertained together with the best strategy for achieving them.

Within this framework, our firm has the resources to offer the highest level of expertise in this field.

In 2020/2021, Maître Christophe Wilhelm obtained the Certificate of Advanced Studies in Mergers and Acquisitions awarded by HEIG-VD (the School of Engineering and Management Vaud), following a 15-month postgraduate training course.

Our firm also works in partnership with Mr. Claude Romy, co-director of the programme set up by HEIG-VD and Romandie Formation/Centre Patronal (the Centre Patronal business and employers’ organisation’s training body for French-speaking Switzerland). Claude is a recognised expert in implementation of the business transfer process in French-speaking Switzerland; he is also Chair of the Swiss M&A Experts Chamber www.ma-experts.ch.

We put the following questions to him on this topic:

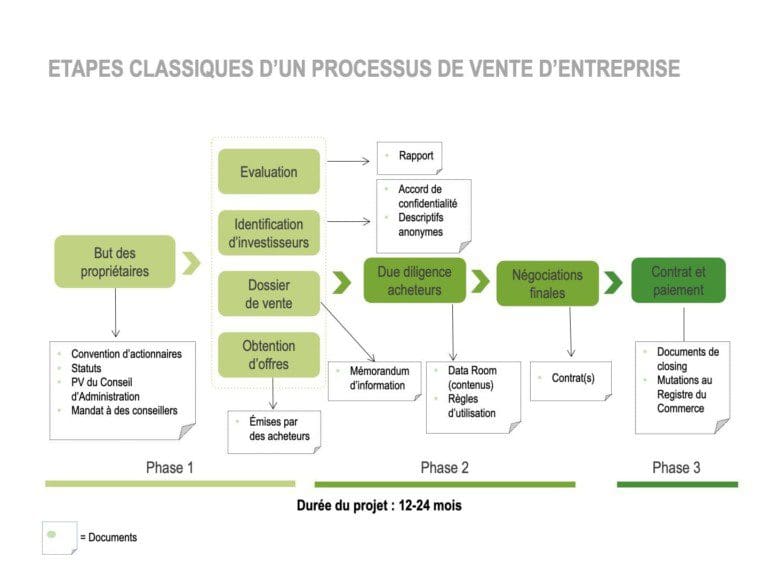

Transferring a business is a complex process. Firstly, the objective to be achieved in terms of ownership of share capital must be set: sale to third parties, takeover by the existing management team or a new manager coming in from outside, takeover within the family. An objective company valuation then needs to be carried out, which may lead to an overhaul or restructuring being undertaken before any transfer. For example, when the business owns property assets, it may be preferable to split them off from the operational side of the business. The transfer itself must then be arranged and subsequently brought to completion, with appropriate support. All of these steps can take months or years, depending on the decisions taken by shareholders and market conditions which may help or hinder completion of the project.

Ideally, this should not be done in a hurry, and the shareholders should retain control of the process. To start with, analysis of the business should be undertaken ahead of its transfer. The aim of this strategic analysis is to establish an overview of the main legal, organisation and financial challenges facing the business and assess the consequences of this when it comes to setting objectives and deciding on the procedure to be followed. This allows the foundations for the transfer strategy to be cemented. In effect, a family business is not transferred within the owners’ family in the same way as it would be if sold to a competitor or to a private equity fund. All the work undertaken in preparing for the transfer amounts to a genuine investment aimed at enhancing the value of the business and its sustainability.

First of all, it is necessary to analyse and obtain an understanding of the general background to the business. Why is it being transferred and to whom? How will this be done? What are the objectives in terms of valuation? And what is the time frame? What is the business’s current positioning and direction in its marketplace? What are competitors doing?

An analysis of the strengths and weaknesses of the business and the state of play in its market will then be carried out.

On this basis, a detailed analysis of the financial situation of the business will of course follow. What is its potential value? Can this be improved? Should any changes be made before the transfer? Should any assets be sold beforehand? What are the legal and tax implications, where relevant?

Lastly, the contractual and legal framework will be drawn up to enable the objectives defined by the strategy to be achieved and the goals set.

The preliminary analysis will therefore serve as a guideline or roadmap. A flexible approach will be taken, meaning that it will be revised regularly during the transfer process and will be followed by a more detailed analysis or subsequent analyses, relating either to variations or specific points relevant to the particular situation of the business, its market, financial or legal circumstances or shareholder situation.

I am of the view that only a lawyer can gain a complete overview of the full range of challenges raised by the transfer. Additionally, unlike other potential stakeholders in the transfer, the lawyer adopts a meticulous approach to handling potential conflicts of interest.

The transfer price is not the owner/transferor’s only criterion for success; other factors such as how the price will be paid, the guarantees required by the purchaser and any tax implications are also key factors in the decision-making process. A lawyer specialising in business transfers can anticipate issues that are likely to arise and plan out the key steps. The lawyer can give the client objective advice and has no ulterior motives in terms of success fees or in relation to management of the owner’s assets.

Consequently, the lawyer can offer their wholly impartial support to the owner at all steps in the procedure. They can advise the owner on the best takeover scenarios, on the basis of the inherent risks. The lawyer can draw on their network of expert professionals (fiduciaries/accountants, tax specialists, business transfer experts, banks, communications consultants) to ensure this complicated operation is successful.

Newsletter

Keep in touch

expertise

© 2024 Wilhelm Avocats SA – Politique en matière de confidentialité – Réalisation Mediago